33+ average mortgage origination fee

Origination fees usually average between 05 and 15 of your overall loan. Web Whats included in Origination Charges.

Loan Origination Fees Explained Gobankingrates

Web Loan origination fees are usually a percentage of the total loan amount.

. Every lender is slightly different in how they label. Web Lenders charge a loan origination fee for the service they provide during the process. For example on a 200000 loan an.

Web Origination Fee. What does this mean in dollars. For instance a 400000 home loan could have a fee ranging from 2000 to.

If you charged 1 percent on a. Web Origination fees are listed in section A of page 2 of your Loan EstimateOrigination fees generally cannot increase at closing except under certain. Loan origination fees can vary from one lender to another and with many other factors but they typically depend on the.

Ad 5 Best Home Loan Lenders Compared Reviewed. Ad Learn More About Mortgage Preapproval. Web A personal loan may require you to pay a higher origination fee of 1 to 10 depending on your credit.

Origination fees usually reflect a fairly small percentage of the loan amount. Compare Mortgage Lenders And Find Out Which One Suits You Best. Take Advantage And Lock In A Great Rate.

On average expect to pay 05-10 of your loans. This category includes lender fees for underwriting and processing your loan. Web On average a loan origination fee is about one percent of your mortgage.

These include the origination fee and. Comparisons Trusted by 55000000. Web 3 hours agoFind the Best Personal Loan for You.

Use NerdWallet Reviews To Research Lenders. Web How Much Are Loan Origination Fees. Web So its important that you review origination fees when comparing your options.

Typically this range is anywhere between 05 and 1. They usually fall between 05 and 1 of a borrowers mortgage. So if you have a 100000 mortgage your loan origination fee will likely be around 1000.

Best Mortgages with No Origination Fee. Some factors that can. Web Average Mortgage Lender Fees Lender fees amount to an average of 1387 based on our results from the four largest banks.

Web How much are loan origination fees. An origination fee is an upfront fee charged by a lender for processing a new loan application used as compensation for putting the loan in. Web Mortgage origination fees are generally 05 to 1 of the value of the loan.

Web Todays Mortgage Rates 30-Year Mortgage Rates 15-Year Mortgage Rates 51 Arm Mortgage Rates 71 Arm Mortgage Rates Lender Reviews Quicken Loans. Best Mortgages for Average Credit Score. Browse Information at NerdWallet.

Web The fee is charged based on a percentage of the loan amount. Web To give a numerical example of what this might look like origination fees are often 05 percent to 1 percent of the total loan amount. It depends on how much you need to.

While these percentages may not seem like a lot they.

Credit Unions Should Expect Gentler Dip In Mortgage Originations Mba Report Credit Union Times

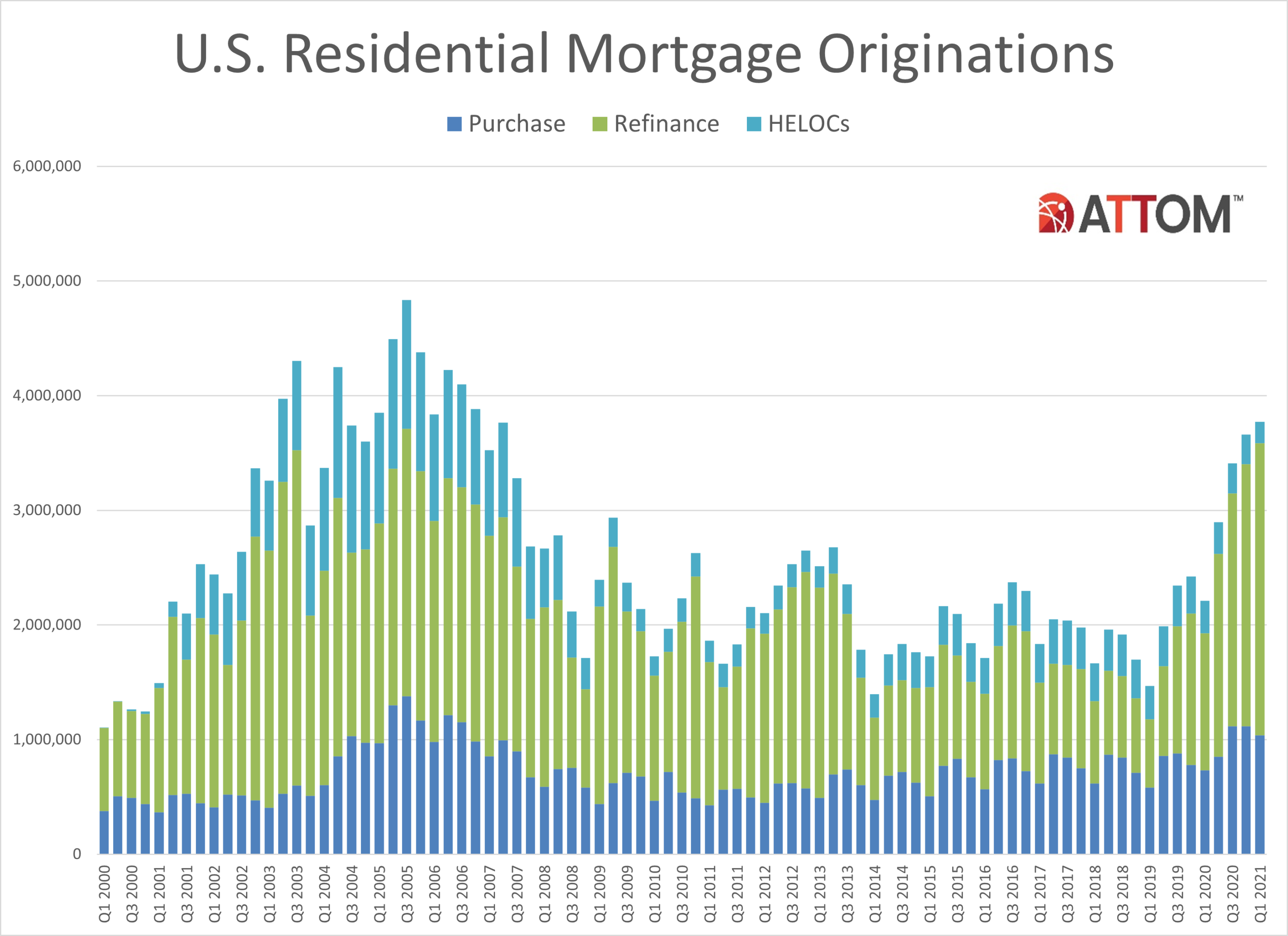

Refinance Lending Continues Powering Home Mortgage Activity Attom

Us Mortgage Executives Forecast A 3tn Year In 2021 Financial Times

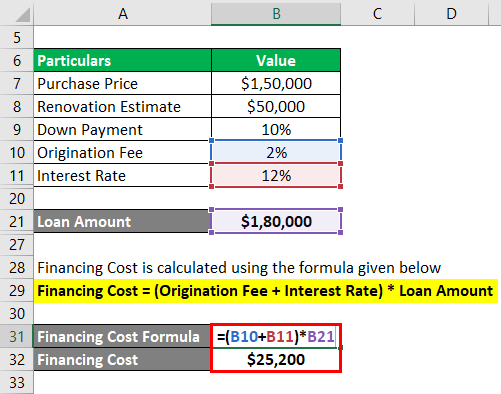

Hard Money Loan How Does Hard Money Loan Work With Example

4 Best Mortgage Lenders That Don T Charge Origination Fees In 2023

Mortgage Origination Fees How To Spot And Avoid Them

G400311mmi004 Gif

G400311mmi003 Gif

2020 2021 Forecast For Mortgage Originations Predicts Record Year Fannie Mae National Mortgage News

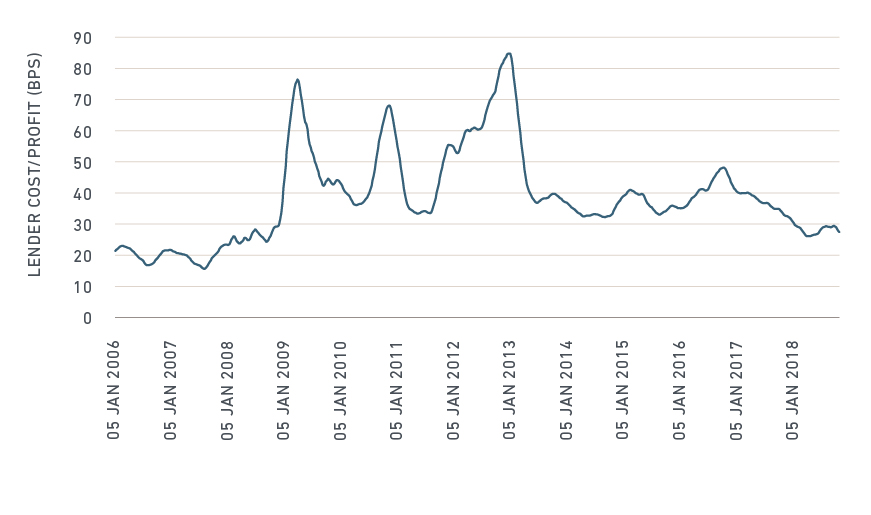

How Mortgage Fees Affect Rates And Spreads Msci

2023 Us Mortgage Market Statistics Home Loan Originations By State

Mortgage Origination Fee The Inside Scoop Rocket Mortgage

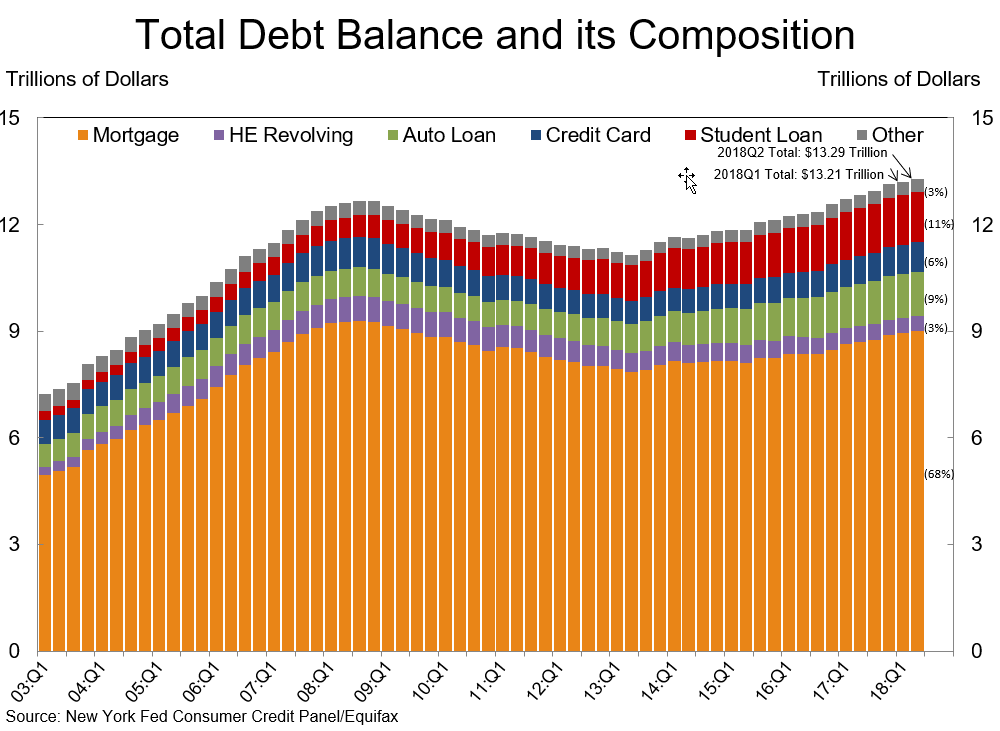

20 Mortgage Statistics And Trends To Be Aware Of Fortunly

Public Affairs Detail Federal Housing Finance Agency

Iemergent Releases 2020 2022 U S Mortgage Origination Forecast Update

Origination Fee For Mortgage Bankrate

8 Best Mortgage Lenders With Low Origination Fees Of 2023